pay indiana unemployment tax online

Unemployment Tax Payment Process. Search by address Search by parcel number.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their ownPlease use our Quick Links or access on the images below for additional information.

. The Uplink Employer Self Service System provides you with immediate access to services and information. Online Payment Service by VPS. All payments are processed immediately and the payment date is equal to the time you complete your transaction.

If you are requesting a refund. Form UC-1 Quarterly Contribution Report is due the last day of the month. Do not enclose a copy of the federal tax return with the Indiana tax return.

You can find your SUTA Account Number and Tax Rate by logging into your Indiana Uplink account or on any previously filed quarterly. File online using IN Tax. Search for your property.

Please use the following steps in paying your unemployment taxes. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status. Up to 25 cash back Note.

See more information on DORs tax system modernization efforts. Employers paying by debit or credit card should authorize 9803595965 and 1264535957. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Select the Payments tab from the My Home page. 124 Main rather than 124 Main Street or Doe rather than John Doe. Form WH-3 Annual Withholding Tax return is to be filed each year by February 28.

Registering for an Indiana State Unemployment Tax Account. Indiana changed its unemployment compensation law in 2015. This option is to pay the estimated payments towards the next year tax balance due.

Conduct an ongoing job search. Take the renters deduction. To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option.

Find Indiana tax forms. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments from T356000158 are authorized for Indiana SUTA payments. This option is to pay the estimated payments towards the next year tax balance due.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Online filing information can be found at wwwUnemploymentINgov. If you are an employer with an existing SUTA account number be sure to check the Yes option.

These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July 18 2022. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Search by address Search by parcel number.

Rules for Unemployment Insurance Tax Liability. You will receive your Tax ID within a few hours of completing the online registration. Submit quarterly unemployment insurance contribution reports.

To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option. Those who used tax preparation software or online services to file prepare returns for mail-in or file electronically should check to see that the company updated its software to add back unemployment income excluded from the federal. Have more time to file my taxes and I think I will owe the Department.

I need to file my 2020 Indiana individual income tax return and plan to file electronically or prepare my tax return using tax softwareonline services. Claimants can make payments to the dwd office in indianapolis online or by phone but cannot bring payments to a workone office. Generally if you apply online you will receive your EIN immediately.

Individual Estimated IT-40ES Payment. This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Please enclose only those schedules that have an entry.

Welcome to INtax. Indiana Department of Revenue. As a reminder individuals must apply for unemployment benefits online using a computer tablet or smart phone.

Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana Department of Workforce Development. Any wages in excess of 9500 are exempt from this tax. Unemployment Account Number and Tax Rate.

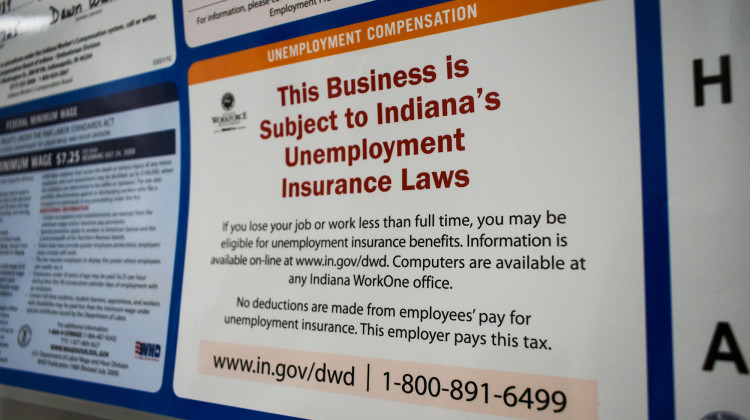

Electronic Payment debit block information. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. For best search results enter a partial street name and partial owner name ie.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. Register online with the Indiana Department of Revenue on INBiz. Through the Uplink Employer Self Service System you have access to on-line services 24 hours a day 7 days a week.

Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. File online using IN Tax.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Please DO NOT attempt to register until wages have been paid. You can apply for an EIN at IRSgov.

Select a payment option. Place Form IT-40PNR on top. Logon to Unemployment Tax Services.

By using our on-line registration system you will be able to receive your account number. Pursuant to 20 CFR 60311 confidential claimant unemployment compensation information and employer wage information may be requested and utilized for other governmental purposes including but not limited to verification of eligibility under other government programs. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247.

In indiana these funds come from a tax that employers must paycalled unemployment taxesthat are collected by the state and paid out to workers who have lost their job. Know when I will receive my tax refund. Pay my tax bill in installments.

To establish your Indiana UI tax account youll need a federal employer identification number EIN. Claim a gambling loss on my Indiana return. Online payment service by vps.

Important Tax Information About Your Unemployment Benefits Wbiw

4 Million People May Have To Pay Back Unemployment Benefitsmillions Could Have To Pay Back Unemployment Benefits If They Miss This Deadline Nextadvisor With Time

Ess Employer Self Service Logon

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Tax Filing Season 2022 What To Do Before January 24 Marca

New Indiana Unemployment Website And Uc 1 Filing Process Greenwalt Cpas

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

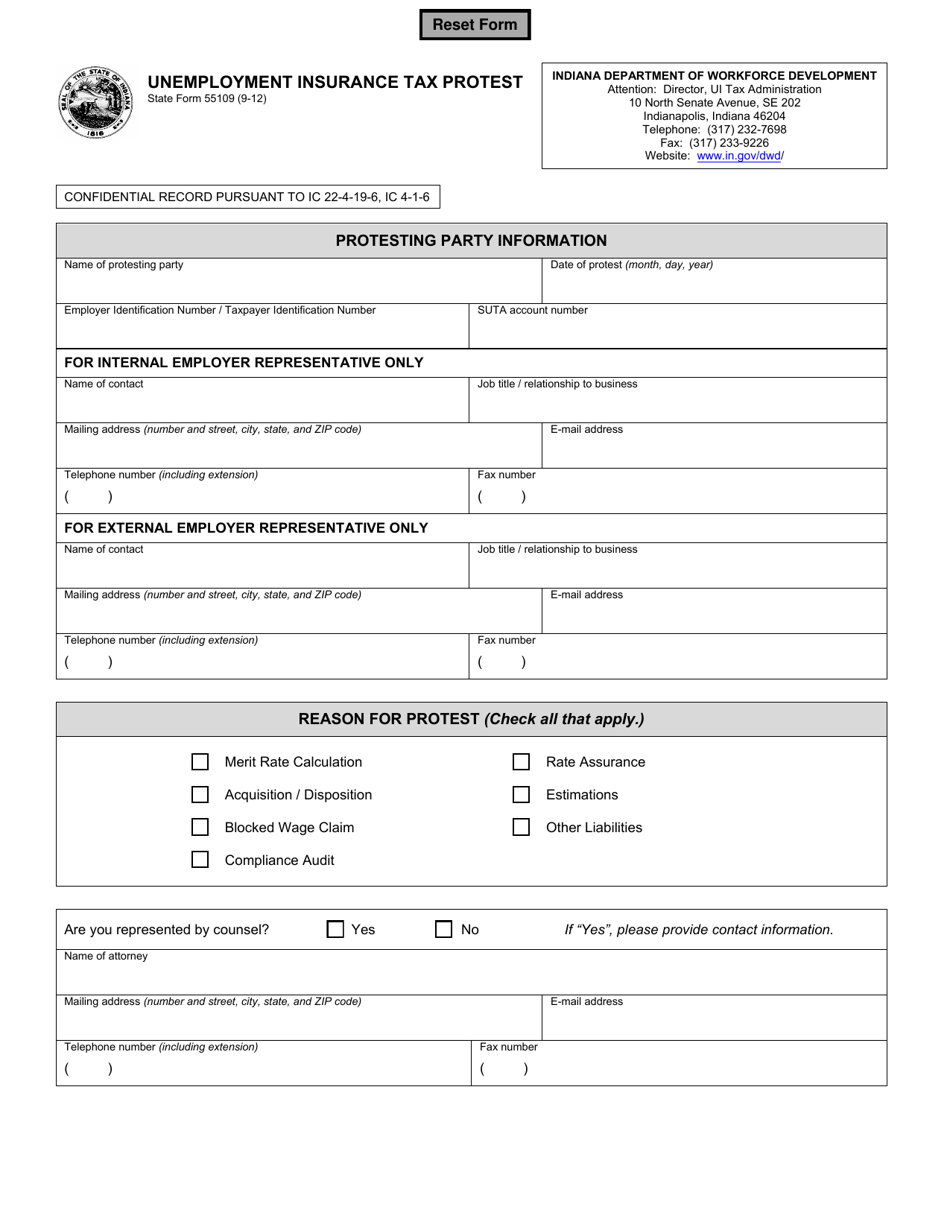

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

No State Income Tax Relief For Unemployed Hoosiers In Bill Headed To Holcomb

Local Market Review January 2019 Housing Data Indiana Snapshots Brownsburg

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Dor Important Tax Information About Your Unemployment Benefits

Unemployment Workforce Management Inbiz

What S The Deadline For States To Choose To Offer 10 200 Unemployment Tax Break As Usa

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Blue Springs Tax Preparation For Business Owners Your Tax Preparation Needs Are As Individual As You Are Alliance Financi Tax Attorney Tax Lawyer Tax Refund

Who Qualifies For Unemployment Millions In U S Didn T Get Any Bloomberg